How CFPs can Have Business - and Life - Changing LTD Client Conversations - Part 3

Lessons from 5 Years and 1000s of Failed Conversations And the Change to Three Years of Success

January 7, 2022 | Written by Samuel Newland CFP

Part 3: How to Have Better Disability Conversations

In the first part of this article series, we learned why it is important to have effective disability conversations for your business and the well-being of your clients and those who depend on them. In the second part, we discussed how we know there is a problem with having impactful disability talks with clients and learning how embracing how to frame these discussions (i.e. sales and persuasion techniques) is admirable rather than shameworthy. Now we will focus on the specific tools and conversations that work and do not work when discussing disability.

Know that the Disability Data Backs You Up; But Do NOT Rely on It

The LIMRA survey cited a lack of information as one of the leading causes for why disability is not purchased. Whether this refers to people not being aware of how disability policies function to help someone financially or they do not know how common disability is is immaterial for many reasons.

First, most critically is that you know the data support having a disability policy equally if not more than having a life insurance policy. If you believe in disability coverage, your belief will carry through in your tone and your client will more likely believe in it as well. Clients should know that disability is exceedingly common. More than 25% of 20-year-olds will become disabled before retirement according to the Social Security Administration. If you are not aware of the disability statistics that support having disability insurance, view the disability numbers at @InsureNGI.

Secondly, statistics confuse people and lead to the other leading reason LIMRA cites for people not getting coverage – indecision. Too many numbers make people think disability is a math problem that can rationally be figured out statistically as being a good or bad choice. This creates paralysis and indecisiveness. Nobody uses mortality tables to convince people to purchase life insurance. Why should disability insurance conversations be any different?

Disability Insurance is Like Bonds to a Portfolio; Cost is Less Important than Believed

The third-most cited reason by LIMRA for not having disability insurance is cost. Obviously, insurance needs to fit a budget and not break the bank. Oddly enough however, cost typically only matters to the client when you as the advisor think it matters. The most important feature regarding cost is for someone to believe they are getting a good deal – not the actual dollar amount.

The reason why value over cost matters can easily be seen through health insurance, life insurance, and bonds. Anyone who pays their own health insurance knows that it costs an arm and a leg and is much more expensive than life and disability insurance. And, yet, everyone pays it. People pay for health insurance because they know they cannot afford one bad day and the medical bills that would follow if they were uninsured. The average parents will also purchase term life insurance – money they hope to waste and never collect on. Life insurance provides the value to survivors if someone passes.

With all insurance, the premium charged for health, life, and disability insurance cost customers more than the benefits given out. If not, the insurance company would go out of business. Fortunately, competition between companies brings the cost close to in line with the true value and benefit of the insurance purchased. Additionally, disability and life benefits essentially scale linearly with the cost (i.e. $2MM of benefit costs double that of $1MM). Therefore, the difference in purchasing behaviors between health/life insurance and disability has nothing to do with the cost-benefit ratio of the protection and everything to do with the perception of value provided.

From an investment portfolio perspective, we know that people do not deploy their money in perfectly mechanical, net-worth-optimizing manners at all times. Clients do not live in apartments with roommates eating ramen every meal. People “waste” money on restaurants and steak. There is great value in “wasting money” in order to prevent loss because it provides tranquility and stability to the buyer.

The pain from loss hurts much more than the positive emotions that come from earning. This same desire to not lose causes most clients to “waste money” on not optimizing their net worth in the long run when they opt for bonds. Disability insurance acts in the same way as bonds. It is a small amount of money that does not go towards equities that works as a tool to help prevent massive loss.

Without Disability, you are Playing Financial Russian Roulette

People need familiar points of reference to make good decisions. The consequences of losing everything because you do not have a disability policy are pretty grave. The Social Security Administration puts the odds of disability at over 1 in 4 of Americans. The odds of losing in Russian Roulette are 1 in 6 – less likely than being disabled. Scary but true. And nobody wants to lose either game.

Why let your clients play Russian Roulette with their finances? Tell them that this is what is happening if they do not have their own personal or employer policies. They will want to know.

Tell Them a Story of Disabled People Like Them; They’re Just Like You

Odds are, your clients are pretty successful financially. For various reasons, all or most of their friends are as well. Furthermore, they probably do not personally know anyone who is disabled. Why? Because people who are disabled are probably not in the same socioeconomic classes because they have lost everything due to their disability if they were not protected. Because your client does not personally know anyone who used to be successful like them and has lost everything, you need to tell them true stories of people who have. In addition, you should make it painfully obvious that they are made of the same cloth as those who lost everything.

(Interesting note: Everyone knows someone who has died regardless of financial success. One reason why it is not hard to convince someone to acquire life insurance).

A Story and One Strategy:

Story 1:

Reading personal finance forums on Facebook, one day I came across a story of someone who angrily wrote that they hate anyone who supports the broken American system.

Here is essentially what they wrote:

- My husband and I did everything right, and now we have nothing: We studied hard in school, went to great universities, got high-paying jobs, bought a house, maxed out their 401ks. Then the husband gets diagnosed with cancer, and they lose everything including the house.

Up to the point of the cancer diagnosis, this probably describes 99% of your clients. Before telling them about the cancer diagnosis, you could probably ask your clients, “Does all this sound familiar? Does this sound like you?” Them answering the question will personalize the result of losing the roof over their heads and enhance the emotional impact of the story and the importance of having a disability policy.

A High-Powered Strategy:

Most people would rather be wrong and with a crowd than right and all alone. This is no reason to misadvise and manipulate your clients. But it does explain why a person’s friend or neighbor buying a nice car and posting it on Instagram causes them to make bad financial choice and buy one for themselves (i.e. Keeping Up with the Jones’s).

An energy company did a study and sent different messages to its customers. The messages compared a customer’s energy use to different groups – the national average, the state average, the city average, and their neighbors. Which was the most effective comparison group for reducing a customer’s energy use and turning off the lights when they leave? Their neighbors, of course.

This matters because your clients do not care what dumb people do. They care what people like them do. Tell your client that most people like them (e.g. other clients of yours, other people or clients in their profession, or other people of their income or net worth) have or acquire disability protection, and they will likely follow suit and get disability. Tell them that most people like them do not have disability insurance, and they will be like the others.

Whether logical or not, people care what others do. Framing disability as something responsible people have like life and health insurance will make people move forward more than any numbers or statistics you can present.

The Happiness Frame

If the prior comparison of using stories of people and clients like them does not work, this strategy of making it about them still may. After a few long conversations with an inquisitive client about whether disability was worth it or not, I finally came around to clearly conveying this idea. Once I did, he immediately agreed to apply and even asked, “Why didn’t you explain it to me this way from the beginning?”

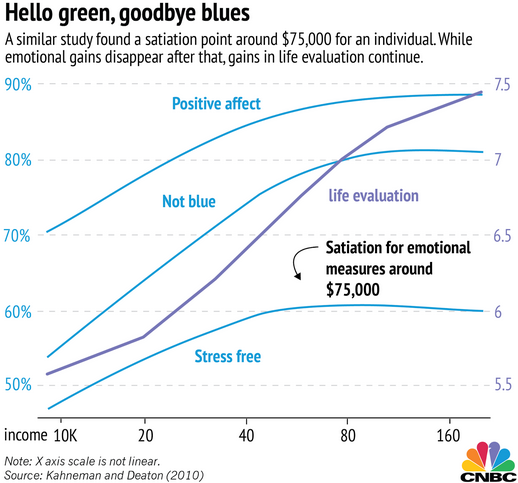

The relationship between income and happiness has many nuances as shown above. In general, people’s happiness increases by not being poor but does not increase much from not being poor to being rich. As an aside, the same general effects can be seen when comparing net worth and happiness as with income and happiness.

I used to think it was a good idea to educate people on this effect, but – just like too many statistics – it tends to make people think too much, be confused, and refrain from making a decision. It is much more powerful to ask them directly about their own experience with their wealth and happiness.

Here are the questions to ask to give your clients the lightbulb moment:

- Your net worth is $X, no?

- Yes. That’s right.

- Do you remember roughly how happy you were when you had $Y*?

- Yes.

- Were you significantly less happy or about the same?

- About the same.

- Knowing this, do you think you will be significantly happier having Z**?

- Probably not.

- Do you ever remember being broke or poor? How was that?

- Terrible.

- Right? I can relate. As long as you can still accomplish all your personal and financial goals, do you think it would be a terrible idea to look into using a little bit of your money in your overall financial plan so that you do not ever experience being broke or poor again?

- No.

- Great. I think a long-term disability policy is the solution to this. Since you are not opposed, let me make an introduction to my CFP disability specialist so that we can get you the best protection and rates available in the market for you.

- Sounds good.

Y* = significantly less than their net worth but far from broke

Z** = their net worth plus 2-3% of their income (the approximate annual cost of a disability policy)

When using this line of reasoning with their direct experience, I do not recall a single client surprising me with an answer that they thought being broke was remotely okay compared to their current situation of wealth. If they have never been poor, it can be hard for them to grasp how hard it is to be poor. Consequently, it is best to ask if they believe they are much happier than poor people they see on the street (as crude as that sounds).

Essentially, everybody wants to be happy. Nobody wants to be miserable. Bringing the conversation straight to their own experience of money and happiness will illuminate why a disability policy is an essential piece of a financial plan to prevent them from being less happy again.

You Asking in the Negative (You can accomplish all of your goals)

If you read the script above or this article series again with a close eye, you will notice that most questions and ideas are not presented as “do you want to,” “wouldn’t it be great,” or “would you like to.” Instead, ideas are presented in the negative where a no answer is what gets people to where you want them to go.

This technique of asking in the negative is one of the main negotiation techniques taught by Chris Voss who was the former lead hostage negotiator of the CIA and is well-regarded as one of the best negotiators alive. He has a MasterClass on negotiation and leading business school professors and authors such as Harvard consult him and allow him to provide guest lectures at their schools.

Asking in the negative works for a few simple reasons. First, people are prone to being comfortable and lazy and not taking action. People generally do not want to do things if they do not have to. Asking people if they want to do things asks them if they desire to act. This typically will result in a no and inaction.

Second, no inherently feels more safe and secure like there is more personal agency in saying no than yes. Why? Because people have been conditioned to feel sold rather than helped by salespeople and spam calls that try to convince them to say yes all the way to a sale. A yes question feels like the person wants something from you. I no question feels like you have control.

Third, while it may seem unnatural to ask in the negative, it is actually more polite and recognizant of their feelings by giving them agency to say no. Pardon me, excuse me, and I apologize are all common phrases we use every day to say sorry and acknowledge that we are empathetic and may be inconveniencing others while we do what we need to do (e.g. walking through a crowded area).

- Do you mind if…

- do you think it might be a bad idea…

- would you be completely against…

- would it be terrible if…

- would you be opposed to…

are all ways of acknowledging that you are making a request for action and that action is oftentimes uncomfortable.

As a result of these three factors, the most powerful question you can ask your client is the bold from above and copied here for your convenience:

- As long as you can still accomplish all your personal and financial goals, do you think it would be a terrible idea to look into using a little bit of your money in your overall financial plan so that you do not ever experience being broke or poor again?

It is no surprise that as advisors we are trying to convince and persuade them to take actions that are good for them. It is our occupation to help persuade individuals to make beneficial decisions. It is our duty to not be coy and to use all the tools at our disposal to help our clients make the right choices.

To this end, I hope this knowledge helps you better prepare, care, and even scare your clients into taking the right action when it comes to protecting their income against unexpected changes in health.

We can provide help for free in 2 ways:

- Have any specific questions about the concepts or ideas in this article series or do not think it would be a bad idea to learn more about how to have better conversations

- Or how we can help your clients with acquiring the best life and disability policies for them

Do not hesitate to book a free consultation here.